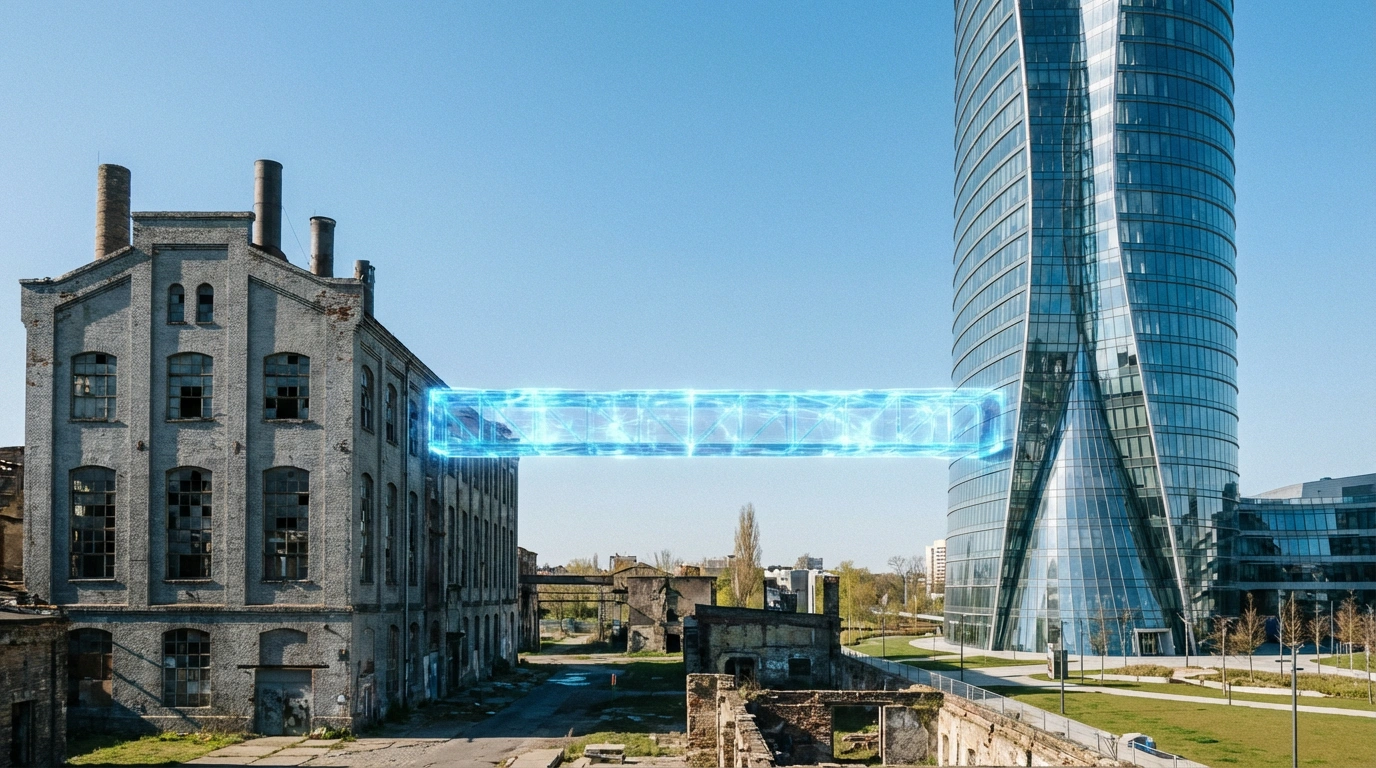

The Strategic Context for Indian Enterprises

Every boardroom in India is discussing generative AI ROI for CFOs, especially finance leaders who need hard numbers, not hype. While the potential for innovation is limitless, the budget is not.

As a modern CFO in India, you aren’t just looking for "cool tech"—you are building an AI business case for Indian enterprises that demands measurable business impact. Implementing GenAI involves significant costs, from cloud compute to API tokens. If you cannot prove the return on investment within 6 months, your initiative risks becoming a "science experiment" rather than a strategic asset.

The burning question is: How do you move from a costly Proof of Concept (POC) to a profitable, scalable strategy?

The Core Generative AI ROI Formula

Most enterprises make the mistake of measuring AI success solely by headcount reduction. In the Indian market, where labor arbitrage is already a benefit, this is a narrow view. To accurately calculate GenAI ROI, you need a holistic formula that accounts for efficiency, velocity, and hard costs.

We recommend this framework:

GenAI ROI (%) = [(Net Value Generated - Total Cost of Ownership) / Total Cost of Ownership] x 100

Where Net Value includes both Hard Savings (Direct Cash) and Soft Savings (Productivity).

Breaking Down the GenAI Value Vector

To build a business case that gets approved, you must categorize your returns into two specific buckets: direct P&L impact and velocity.

Hard ROI: Direct P&L Impact

These are easy to measure and go straight to the balance sheet.

- Agency Spend Reduction: Are you spending ₹50 Lakhs/year on external content or translation agencies? By bringing 40-60% of that workflow in-house with GenAI, you can save ₹20-30 Lakhs immediately.

- Customer Support Costs: Automating Level 1 queries with AI agents reduces "Cost Per Ticket" (CPT). For a mid-sized Indian firm handling 10,000 tickets/month, a ₹50 reduction per ticket saves ₹5 Lakhs monthly.

- Translation at Scale: For pan-India businesses, automating regional language translation (Hindi, Telugu, Tamil) eliminates massive vendor fees.

Soft ROI: Velocity and Innovation

This is where the real money is, often driven by AI copilot productivity gains.

- Developer Velocity: AI Copilots allow developers to write code 30-40% faster. You aren't firing developers; you are shipping features faster to beat competitors.

- Faster Time-to-Market: Launching a product in 3 months instead of 6 gives you a 3-month revenue head start, which can be worth crores in a competitive market like Fintech or Retail.

The Hidden TCO of Generative AI

Don't let "Sticker Shock" surprise you later. A true calculation of GenAI TCO and ROI must include the hidden costs of running these models.

- Inference Costs: Unlike traditional software (fixed cost), GenAI has variable costs. Every query costs tokens. High-volume usage requires optimization.

- Human-in-the-Loop: You need senior staff to review AI output. If a Senior Manager (salary ₹35 Lakhs/year) spends 20% of their time reviewing AI outputs, that is a direct cost to the project.

- Infrastructure: Private models require GPU compute, which is significantly more expensive than standard CPU hosting.

A 3Step GenAI Implementation Framework for CFOs

How do you start without risking your reputation? We recommend a phased approach.

Phase 1: The "Low Hanging Fruit" Pilot (Weeks 1-4)

- Target: Internal Search (HR Policy Bot) or Marketing Copy.

- Goal: Prove 20% efficiency gain with zero risk to customer data.

Phase 2: The "Co-Pilot" Deployment (Weeks 5-12)

- Target: High-cost teams (Developers or Sales SDRs).

- Metric: Measure "Tasks Completed per Hour," not just hours saved.

Phase 3: Deep Integration (Month 4+)

- Target: Connect AI to ERP/CRM for automated decision-making.

- Metric: Revenue impact (e.g., "Deals closed faster").

From Experiment to Financial Strategy

The companies that win in 2025 won't be the ones using AI to write emails. They will be the ones treating AI as a financial asset—measured, managed, and optimized. By using this generative AI ROI framework, CFOs can confidently approve projects that drive tangible growth. Studies from global firms like McKinsey estimate GenAI could add $4.4 trillion to the global economy, making now the critical time to invest.

Ready to build your Business Case?

At PriyaQubit, we don't just build bots; we build bottom-line results.

👉 Book a Free AI ROI Consultation

FAQs on Generative AI ROI for CFOs

Q1: How long does it take to see Generative AI ROI in an enterprise? Typically, "Hard ROI" (cost savings) can be realized within 3 to 6 months if applied to high-volume tasks like customer support or translation. "Soft ROI" (productivity gains) usually becomes measurable after the first quarter of adoption.

Q2: What data do CFOs need before approving a GenAI project? CFOs need a clear estimate of Total Cost of Ownership (TCO)—including API token costs and cloud infrastructure—balanced against specific KPI targets like "Hours Saved" or "Cost Per Ticket Reduction." Avoid approving projects with vague goals like "innovation."

Reference Resource: The economic potential of generative AI: The next productivity frontier (McKinsey & Company) — This report provides a detailed breakdown of the potential economic impact of generative AI, supporting the arguments above.